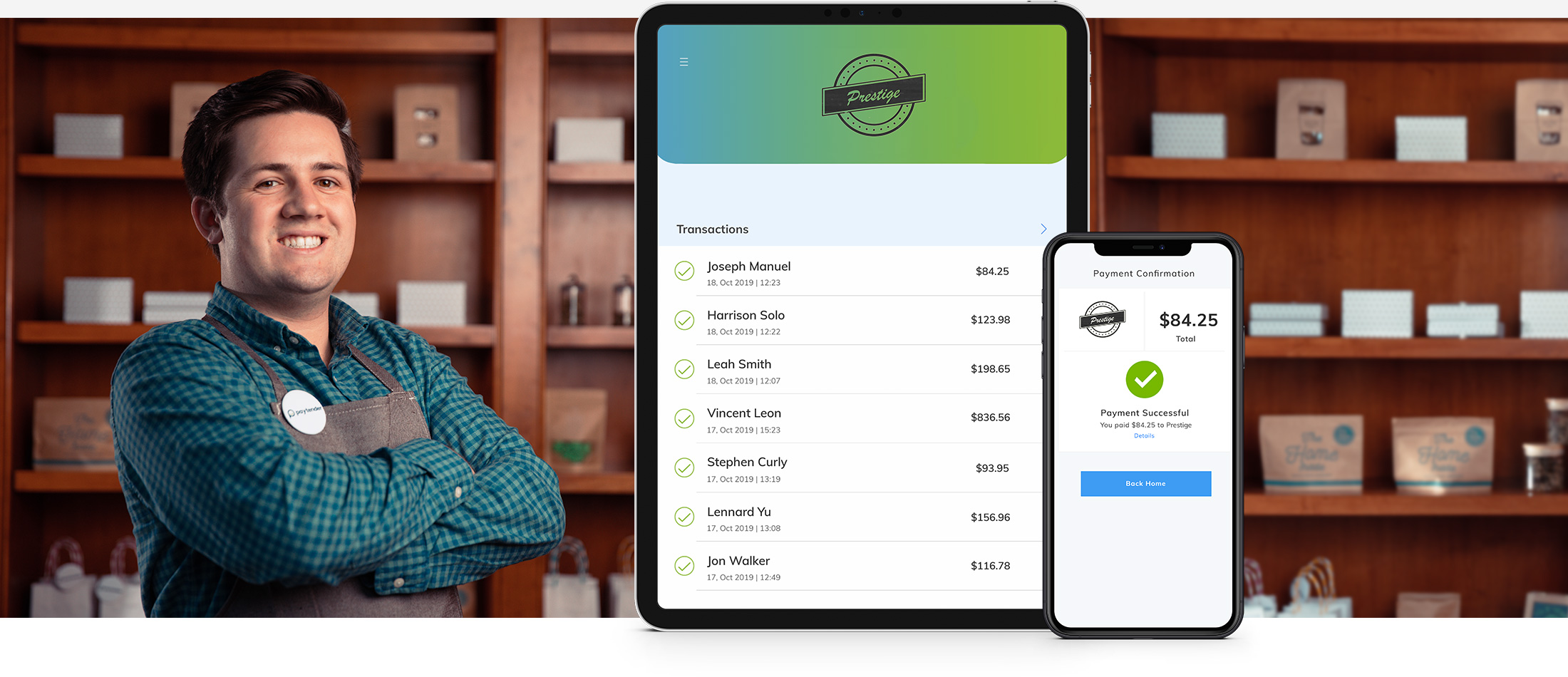

Flexible Mobile Payments

Online

In Store

Delivery

Multi-Channel Payment Processing

Grow your business by enabling payments in-store, online or at point of delivery. Paytender brings convenience to your customers by allowing instant purchases with a linked bank account or debit card.

Increase Cart Sizes and Gain Customer Loyalty

Paytender mobile payment processing adds ease to every part of the ordering and checkout process, giving your business a competitive edge.

One Day Settlements Directly Into Your FDIC-Insured Merchant Account

Access your money faster and improve cash flow.

No Rolling Reserves

Paytender protects your business without imposing rolling reserves. Enjoy simple and predictable fees.

Reduce Cash Handling

Less cash on hand means less time spent counting cash. Use the saved time to service more customers and improve business efficiencies.

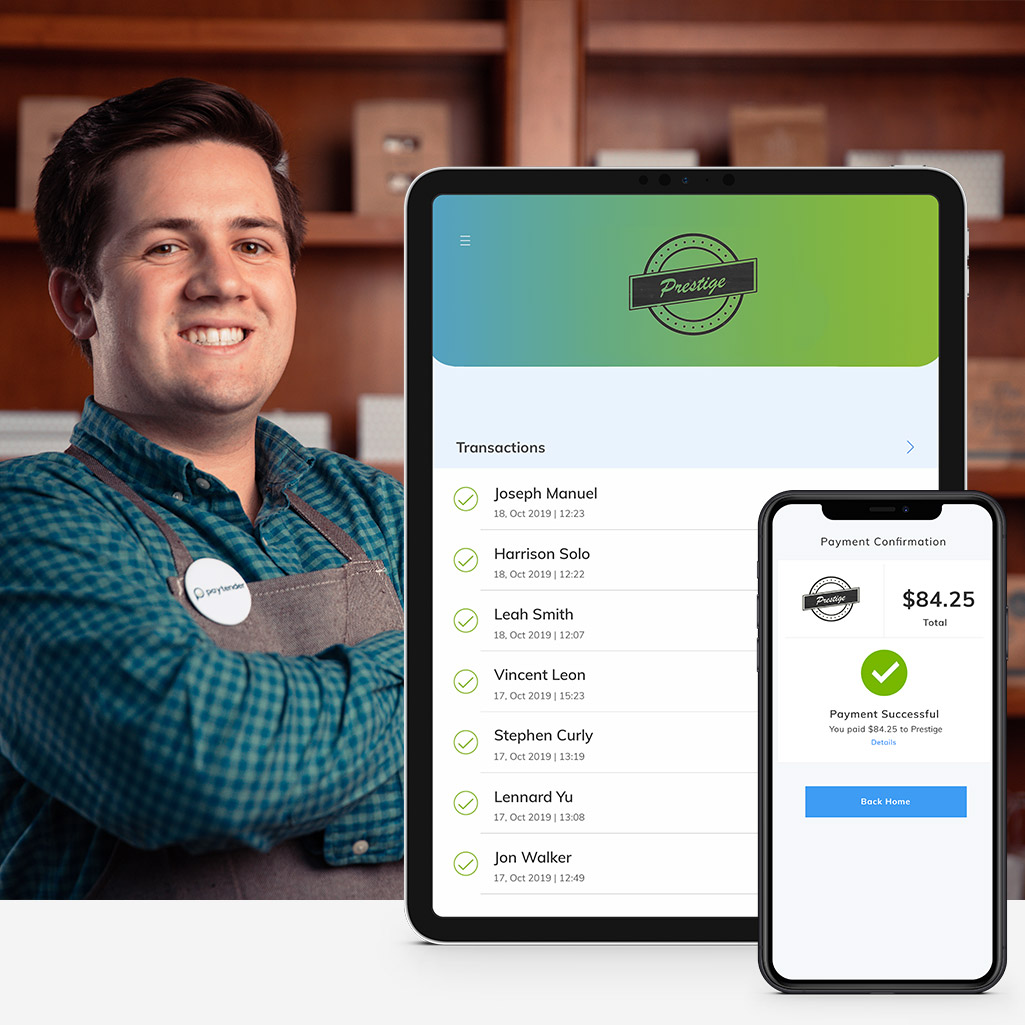

View Sales Performance

At-A-Glance

Analyze sales performance and identify trends with access to visual reports. Sales are reported in an easy-to-view layout within your Online Account Center.

Want to Talk to a Specialist?

Schedule a ConsultationFrequently Asked Questions

-

Where can I use Paytender?

Paytender can be used at participating Retailers - look for the Paytender logo.

-

How much does Paytender cost?

The only consumer fee is $3.00 when loading the Paytender wallet at a Retailer location using an ATM/debit card. Loading funds from a bank account (ACH) is free. Consumers are not charged for purchased transactions.

The fee for a retailer accepting payments via Paytender is a percentage of the amount of the transaction.

-

Does Paytender require special software/hardware to use?

For consumers, only a mobile phone is required to access and use the Paytender wallet. For Retailers, Paytender works with common POS systems, or we can provide a Paytender terminal (Samsung tablet and stand) and a PIN pad device, if desired.

-

How long does it take for funds to load to my Paytender Wallet?

Funds added by Debit Card will appear immediately. Funds added from a bank account will require 1-3 days to arrive at your Paytender account. Please also allow 1-3 days for initial verification of new bank accounts added.

-

I'm a merchant, when will funds be deposited into my bank account?

Settlement of purchases will occur in one day.

-

How do I get help?

Whether you are a merchant or consumer, you can contact us at help@paytender.com or call us 1-800-687-1557