Premier Business Banking

Grow your business from a solid foundation of financial services.

Get StartedNo application fees or commitments

How It Works

Secure Deposits

With Old Missouri Bank, member FDIC, your money is protected for cash, ACH or wire deposits.

No Bank Account Closures

Bank transparently. Deposit money, pay employees, write checks, transfer money and more without fear of any sudden bank account closures.

Watch Your Money Grow

Earn interest on excess money in an interest-generating bank account.

Control and Manage Finances in Your Business' Name

Keep your money protected. Be wary of providers offering to hold your money in their account to transact on your business’ behalf. With a OMB BankPay Account, your money is always yours and will never be given away.

Don't Let Cash Compromise Your Safety

Get cash picked up from the safety of your business location. Schedule convenient cash pickups that become easily accessible in your account after one business day.

Your Money is Always Yours

Your money is always held at Old Missouri Bank, member FDIC. Run your business with the peace-of-mind knowing your hard-earned money is in good hands.

Maximize Earnings on Unlimited Deposits

Is your cash working for you or against you? Your funds can grow in an interest-generating account. With no restrictions on deposit amounts, there are no limits to the amount of interest you can earn.

Don’t Limit Your Options to Get Paid

Easily send and receive money via ACH, wire or check from your OMB BankPay Account. Our cash pick-up services let you accommodate your partners' cash payments with security and convenience. Manage payments easily with hassle-free invoices. Get paid quickly by specifying payment due dates and terms on electronic invoices.

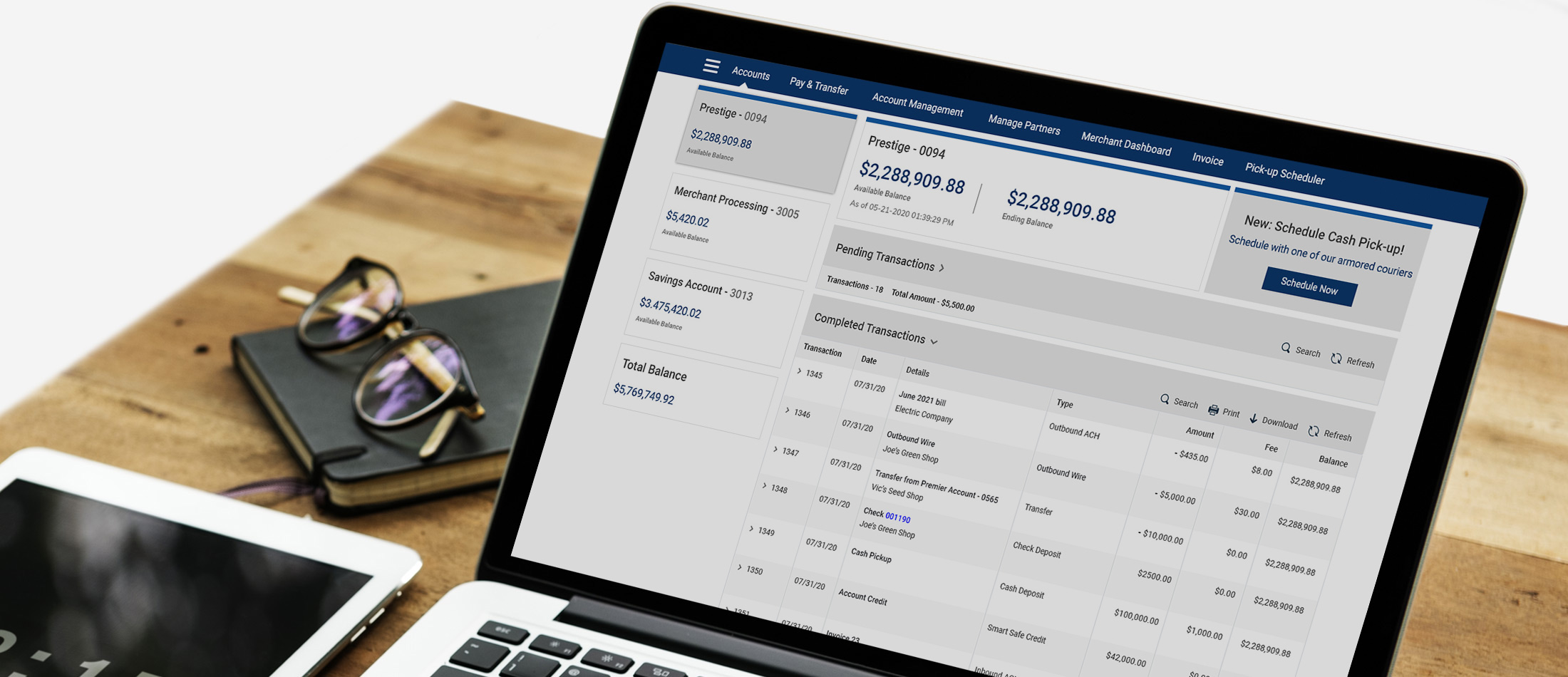

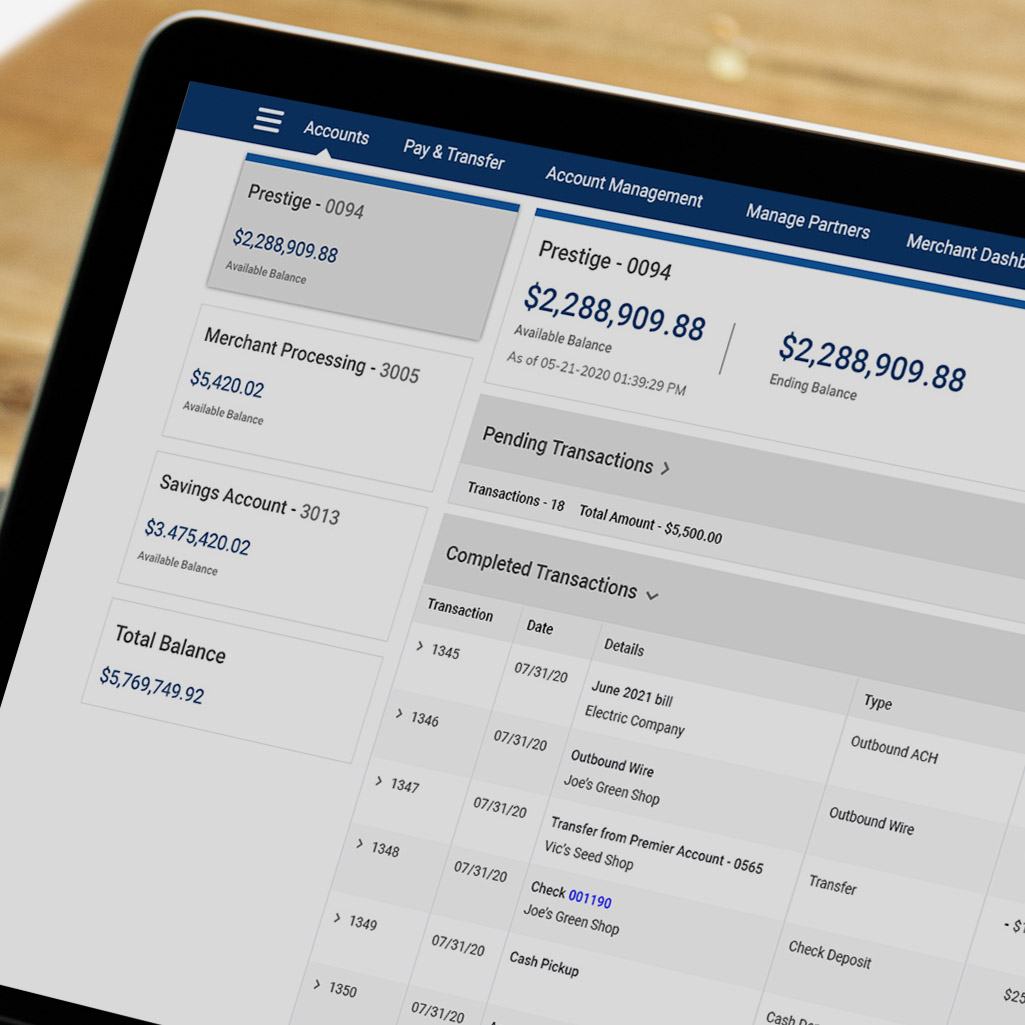

Manage Business Finances from a Central Online Center

Your time is valuable. Be smart and efficient using OMB BankPay to manage your business finances. View balances, monitor activity, make payments, send invoices, write checks and more from your Online Account Center.

Want to Talk to a Specialist?

Schedule a ConsultationFrequently Asked Questions

-

Who is Old Missouri Bank?

Founded in 1999 with a group of local Southwest Missouri investors, Old Missouri Bank is a strong community bank headquartered in Springfield, Missouri.

We are committed to helping families, businesses and communities succeed while growing and investing in our vibrant region, yet serving clients digitally throughout the United States.

OUR MISSION:

We are committed to providing the best banking experience for our community and to help build a bright future for the people we serve.

OUR VISION:

We strive to be the premier community and business bank, through building long-term relationships, that allow our customers, communities, teammates and shareholders to prosper.

CORE VALUES:

INTEGRITY

We do the right thing.

COMMITMENT

We keep our word.

RESPECT

We value our people.

EXCELLENCE

We give our best.

COMMUNITY

We make communities better.

INNOVATION

We seek out new ideas.

-

What are the Fees?

Our simple Fee Schedule is available when you register to access the Account application. A fee is charged on most deposits, and armored cash courier service will be quoted and billed separately based on the pickup location(s).

-

What is ACH?

Automated Clearing House (ACH) is an electronic network used to make financial transactions in the United States between participating depository institutions. Rules and regulations that govern the ACH network are established by NACHA and the Federal Reserve. ACH is commonly used for business-to-business payments and federal, state and local tax payments.

-

How do I pay my vendors and taxes?

Your vendors and other payees can be set up in the online account center. Each payee will undergo a due diligence review and must be approved by us before you can pay them. Once a payee is approved, you can pay them electronically or by check through the online account center.

-

Where will my cash be taken?

Your cash will be picked up and transported by a secure, armored courier service for deposit into your OMB BankPay account. You may schedule cash pickups as needed (fees apply). Logging into your account will give you access to the status of deposits.

-

Will my account be protected or insured?

Deposits are FDIC-insured up to $250,000.

-

Are my transactions reported to the Federal government?

Yes. Transactions will be reported on a quarterly basis. OMB BankPay operates in full compliance with the Bank Secrecy Act of 1970 (BSA), sometimes referred to the Anti-Money Laundering Law (AML), or BSA/AML. The law requires financial institutions (traditional banks, credit unions and thrifts, as well as non-bank financial institutions and money services businesses) in the United States to assist U.S. government agencies in detecting and preventing money laundering.

Additionally, OMB BankPay is required by law to perform anti-money laundering checks and to keep specific records of events that could signal the occurrence of money laundering. We operate in accordance with FinCEN's guidelines on providing financial services. This includes filing a quarterly report containing all financial transactions, filing Currency Transaction Reports (CTR) relating to cash transactions exceeding $10,000 in one business day, and filing a Suspicious Activity Report (SAR) if a transaction may be illegal or an attempt to launder funds from illegal activity. Reports are filed electronically with the Financial Crimes Enforcement Network (FinCEN), a bureau of the United States Department of the Treasury. -

How do I reach a representative?

Call 877-737-0064 or send an email to info@ombbankpay.com.

Current OMB BankPay clients should contact their Dama Financial Relationship Manager or email clientservices@damafinancial.com